Financial Systems Regulation and Networks

Developing a policy framework for technology-driven financial regulation and modelling financial networks to contribute to the resilience of financial systems

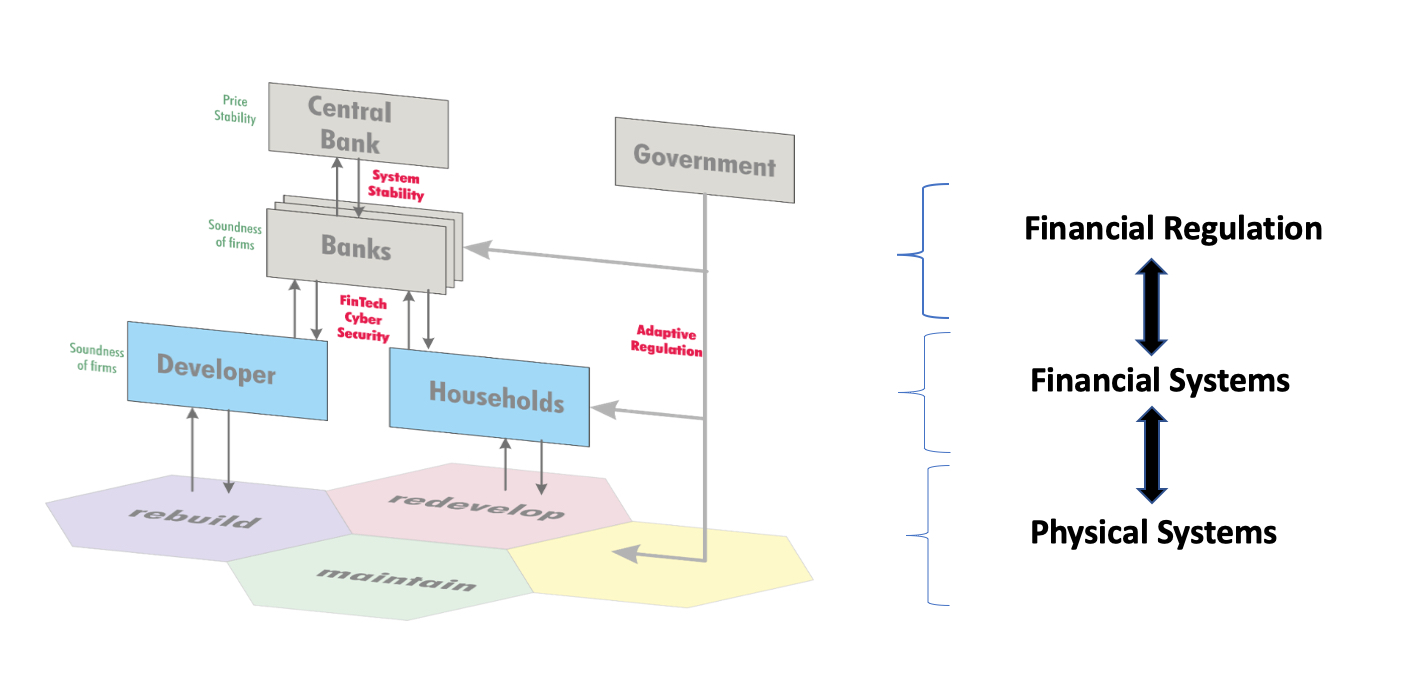

While the application of artificial intelligence and emerging technologies are not new in the financial industry, their potential to improve financial systems resilience has not be adequately explored. As such, this module aims to develop a novel policy framework for technology‐driven financial regulation and model firm networks and investor behaviour.

Specifically, the team will develop artificial intelligence-driven approaches to develop and implement financial regulations more efficiently, such that ad hoc decision-making will be facilitated by intelligent systems and law-making will be significantly automated.

It will also develop models to analyse the networks of mergers and acquisitions as well as online retail investor behaviour, to enhance understanding of the implications of corporate decisions and investor behaviour on firm value and financial market resilience.

Expected outcomes

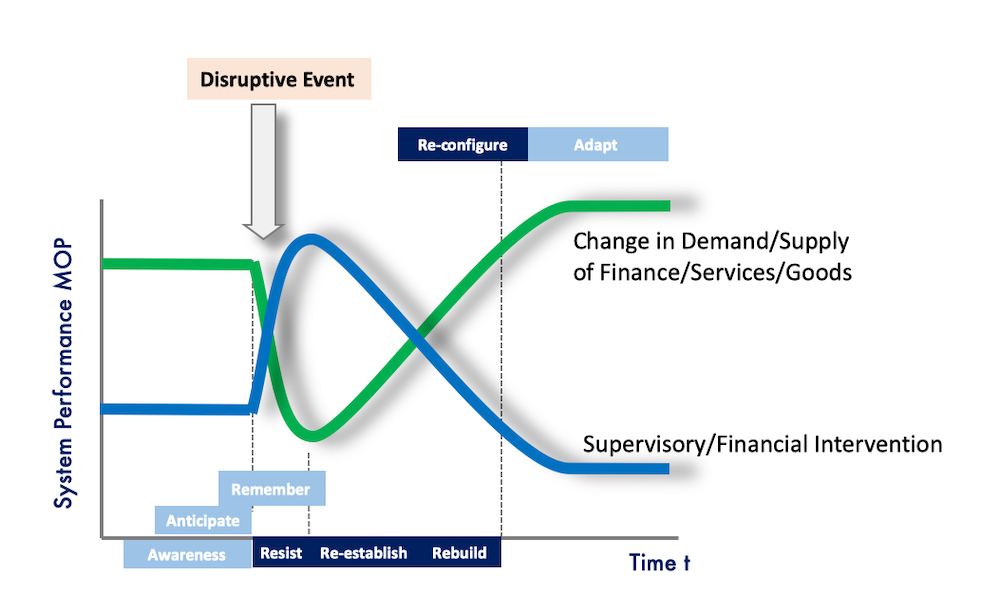

The proposed approaches contribute to the resilience of financial systems on several dimensions of the overall resilience framework:

- improved adaptability of financial systems through smart regulation enforcement

- improved re-configurability of the interdependent financial and urban transformation systems through smart regulation setting

- new resilience insight on the spread of disruption within networks of firms through the analysis of mergers and acquisitions

- improved understanding of the robustness of cyber-human systems by modelling the influence of online social investing platforms on the expectations and beliefs of economic actors